H&r block estimator

POPULAR FORMS. Its safe easy and no cost to you.

Premium Online Tax Filing And E File Tax Prep H R Block

The sample mean need not be a consistent estimator for any population mean because no mean needs to exist for a heavy-tailed distributionA well-defined and robust statistic for the central tendency is the sample.

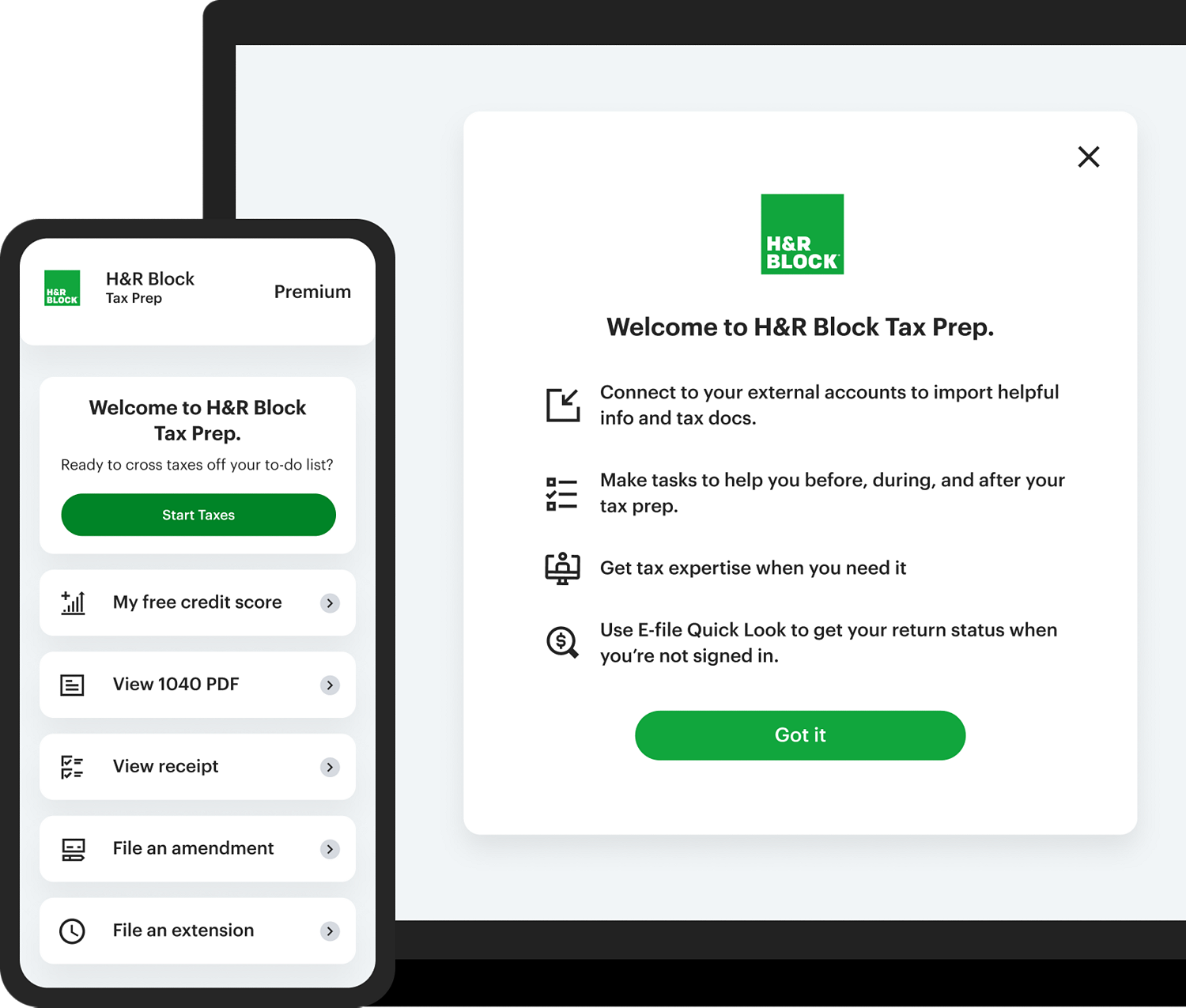

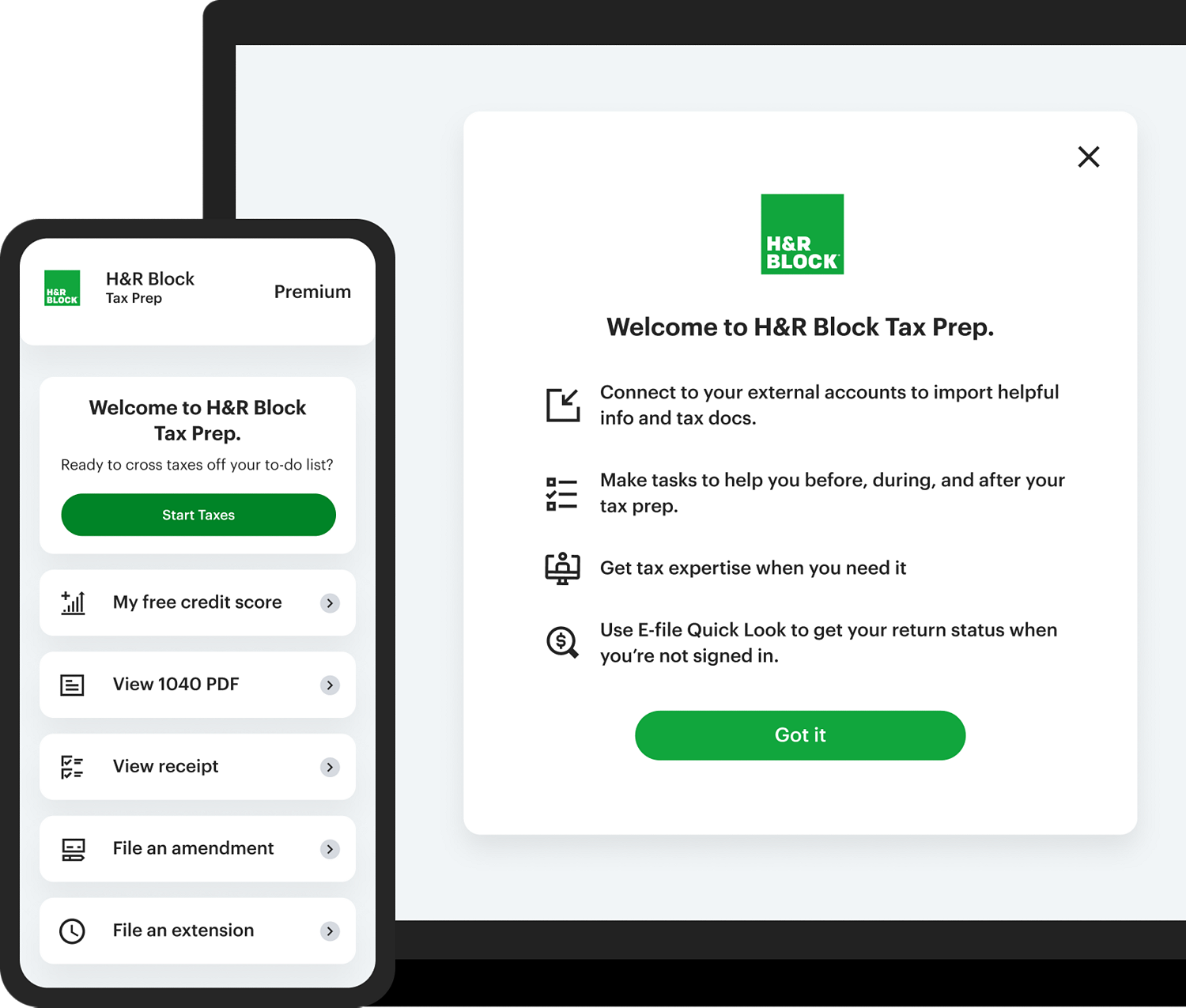

. Using the HR Block refund estimator is now a lot easier and calculates a more accurate estimate of your refund. However the calculator didnt have the best user experience. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

A qualifying expected tax refund and e-filing are required. Neither H. This free tax refund calculator can be accessed online and because you can use the calculator anonymously you can rest assured that your personal information is protected.

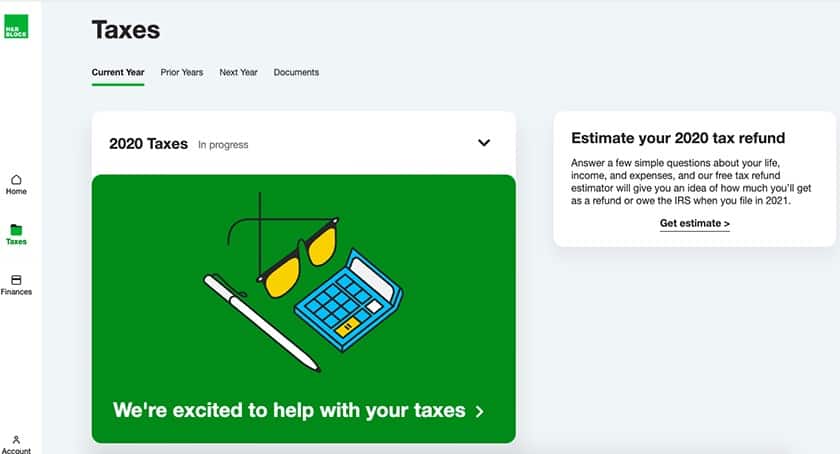

The HR Block online tax calculator has been a popular way to estimate tax refunds for years and can really help with financial planning. The HR Block tax calculator 2022 2023 is available online for free to estimate your tax refund. Ready to Prepare and eFile Your 2021 Taxes.

HR Block Maine License Number. Agency a state the District of Columbia a US. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

A qualifying expected tax refund and e-filing are required. Free Tax Calculators. Here are several easy ways to cut costs when moving to a new home.

2022 Tax Return and Refund Estimator for 2023. HR Block is a registered. 2021 HRB Tax Group Inc.

Individual Tax Return Form 1040 Instructions. Use your estimate to change your tax withholding amount on Form W-4. Property tax rates in Ohio are higher than the national average which is currently 107.

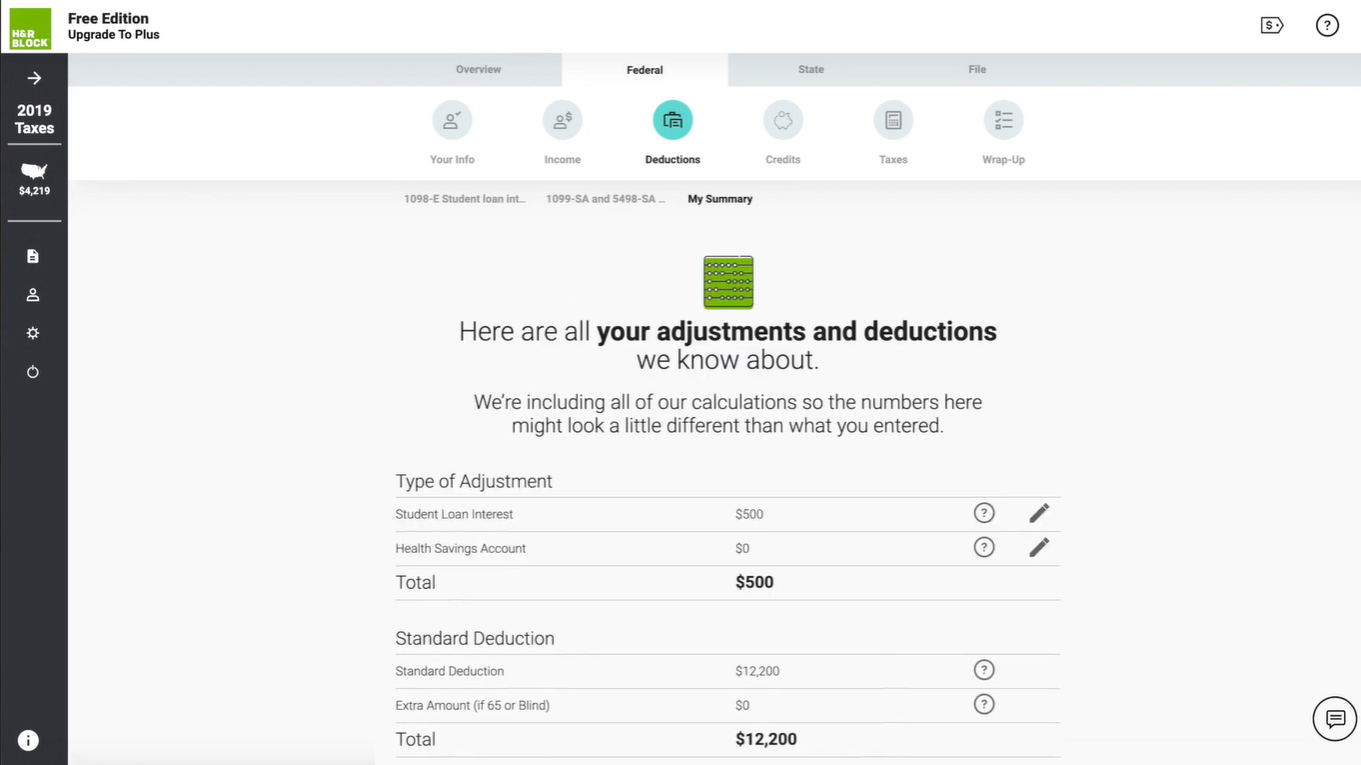

Estimate Your 2019 IRS Tax Return. 10 Easy Ways to Cut Moving Costs. When to Use a Tax Liability Estimator and Check Withholding.

Get rid of your excess belongings - The easiest way to save money on a move is to simply get rid of unnecessary household items. HR Block Maine License Number. UnMax Your Tax with Over 10 more easy to use Tax Calculators.

However standard text messaging and data rates may apply. HR Block does not provide audit attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Is Mortgage Interest Tax Deductible.

Will I get a refund or owe the IRS. FS-2018-14 August 2018 People often rent out their residential property as a source of income particularly during the vacation-heavy warm summer months. Valuable and free tax tools like the W4 Withholding Calculator and Tax Estimator can be used to help with what to claim on your W4 and keep track of all your necessary forms deductions and tax paperwork in response to new tax lawsor if you start a new job or experience new personal circumstances so you arent caught off guard at tax time.

The biggest reason this estimatorcalculator is so handy is that it brings a lot of variables into its estimate. H. Start the pre-move purging process early by cleaning out your closet.

IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. Neither H.

In 1878 Simon Newcomb took observations on the speed of light. For example things like child tax credits. The tax identity theft risk assessment is based on various data sources and.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2662 which. Lets look at TaxCaster and see how it analyzes your income and key tax factors to. EIC Earned Income Credit Calculator.

Answering a few questions about your life income and expenses with our tax calculator will answer the questions we all want answers to. The data set contains two outliers which greatly influence the sample mean. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

To change your tax withholding amount. IT Income Taxes. Looking to save money on your next move.

To use the tax calculator. Overview of Ohio Taxes. IT is Income Taxes.

Dare to Compare Now. You can withdraw your consent at any time by emailing us at unsubscribehrblockca. Enrolment restrictions may apply.

This course is not intended for nor open to any persons who are either currently employed by or seeking employment with any professional tax preparation company or organization other than HR Block. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2662. Start Now - For Free.

This is a simplified way to look at your estimated tax refund. Two Websites To Get a W2 Online Copy for 2021 2022. The average effective property tax rate in Ohio is 148 which ranks as the 13th-highest in the US.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2662 which fulfills the 60-hour qualifying education requirement imposed by the. You are not required to file Form 1099-INT for payments made to certain payees including but not limited to a corporation a tax-exempt organization any individual retirement arrangement IRA Archer medical savings account MSA Medicare Advantage MSA health savings account HSA a US. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Instructions for Form 1040 Form W-9. Submit or give Form W-4 to. See terms and conditions for details.

How Much is the New Standard Deduction. Tax Refund Estimator For 2021 Taxes in 2022. Enrolment in or completion of the HR Block Tax Academy is neither an offer nor a guarantee of employment.

See terms and conditions for details. If your income is not similar you can use the Income Estimator available when you complete the FAFSA online at wwwfafsagov. Or keep the same amount.

After You Use the Estimator. Its a good idea to take a look at your tax situation now so that youre not surprised at tax time with a smaller refund or a balance due. The tax identity theft risk assessment will be provided in January 2019.

However standard text messaging and data rates may apply. The TurboTax TaxCaster is an all-in-one online tax tool that helps you work out a range of tax-related figures. A new client is defined as an individual who did not use HR Block or Block Advisors office services to prepare his or her prior-year tax return.

Request for Taxpayer Identification Number TIN and Certification. Ask your employer if they use an automated system to submit Form W-4. 2021 HRB Tax Group Inc.

By clicking the Subscribe button you consent to receiving electronic messages from HR Block Canada regarding product offerings tax tips and promotional materials.

H R Block Tax Software Review 2022 Nerdwallet

See Your Refund Before Filing With A Tax Refund Estimator

Turbotax Vs H R Block Which Online Tax Service Is Best

See Your Refund Before Filing With A Tax Refund Estimator

How Will I Get A Stimulus Check Payment H R Block

Guarantees H R Block

H R Block Support Hrblockanswers Twitter

H R Block Tax Software Review 2022 Nerdwallet

H R Block Review 2022 Pros And Cons

Turbotax Vs H R Block Key Differences What S Best For 2022

See Your Refund Before Filing With A Tax Refund Estimator

See Your Refund Before Filing With A Tax Refund Estimator

H R Block Vs Jackson Hewitt Comparison 2020 Tax Software Service

H R Block Washington Ia Home Facebook

2021 Child Tax Credit Stimulus And Advance H R Block

H R Block Review 2022 Pros And Cons

Tax Help Tips Tools Tax Questions Answered H R Block